Markets braced for chaos after Trump triggers record-breaking crypto crash

City traders on alert for panic selling after $400bn slump in less than 24 hours

Donald Trump earlier this week threatened with further 100 percent tariffs on China, which has led to one of the most significant plunges in cryptocurrencies in memory, reawakening fears of wild global markets next week.

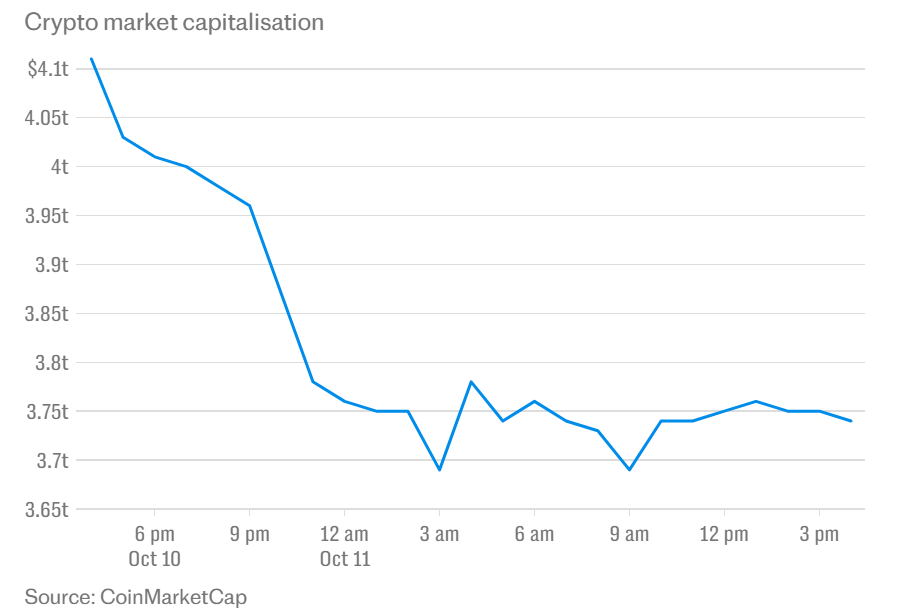

In fact, the crypto market suddenly lost around USD 400 billion (GBP 300 billion) in the value just under 24 hours after Mr. Trump on Friday night pledged huge additional levies on Chinese imports within weeks.

The Bank of England is monitoring the situation as part of its normal practice. Officials expect a turbulent opening in Asian markets on Sunday night to affect the Bank. The central bank has not commented, but traders in the City are preparing for panic selling. Futures markets already show a sharp projected decline of about 6 percent.

For the past few nights, traders have been utilizing huge borrowed funds to bet on Bitcoin and other cryptocurrencies. Coincidentally, their losses reached record heights that day, markedly signaling a whopping loss of $19 billion. This loss was more than twice the next biggest single-day loss in 2021, which crashed the market to an $8.5 billion hit, making this unprecedented.

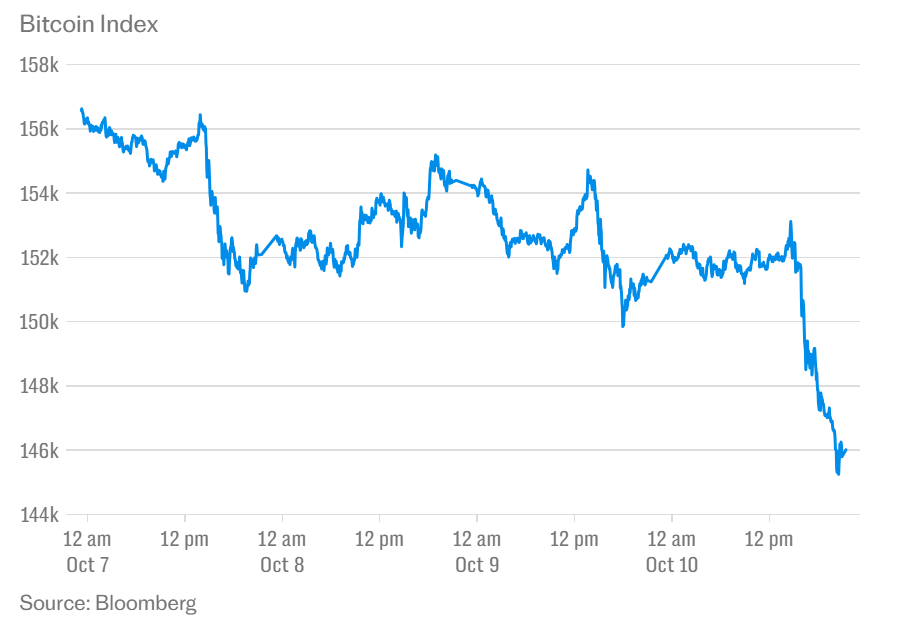

Unlike traditional financial markets, the cryptocurrency trade is open 24/7 and, as a result, Mr.Trump’s threat led to an enormous rush of selling that lasted into the weekend. Last Friday, the largest one, which is Bitcoin, dropped more than 10%. Its price by Saturday fell further 5.9% to £83,838.

Traders using borrowed money to bet into Bitcoin or other virtual coins made losses not less than $19 billion in a single night, on Friday. The amount in losses is more than double that of the next largest single-day loss occurring in 2021, when the market lost an overall $8.5 billion.

In reality, Bitcoin value, by far the biggest among cryptocurrencies, fell by more than 10 percent on Friday due to all this tension. It fell further the next day to 5.9 percent to settle at £83,838.

Speculators who borrowed money to bet on price movements in leveraged trading suffered some of the heaviest losses. The digital currency bubble drove prices to soar, then collapse rapidly, wiping out positions and causing colossal losses.

Against such a backdrop, Ukrainian crypto blogger in the public eye succumbed by suspected suicide outside his terrible shop of horrors on Saturday.

Kyiv Police found 32-year-old crypto entrepreneur shot dead in his car. Police wrote on their official Telegram channel that he told his relatives he felt depressed because of ongoing financial difficulties. Locals call him Kostyantyn Ganich, but he uses the name Kostya Kudo online. His Telegram channel, which provides cryptocurrency advice to tens of thousands, posted that “he has tragically passed away.”

“A lot of individuals thought they would gain from this crash. Many were over-leveraged. Some traders who were having multimillion-dollar portfolios were finished by this,” Marcus Sotiriou, a partner at Impact Fundry and crypto analyst, said.

Some exchanges were in disarray: Binance apologized for “intermittent delays or display issues” under “heavy market activity.”

There are allegations and doubts on the possible insider trading since anonymous accounts managing almost $200m made their bets on the price falls less than an hour before the tariff announcements.

There has been speculation that was not substantiated about somebody who had prior knowledge of the announcement by the US president and used that to profit from the crash.

Joshua de vos of CoinDesk, an industry data provider and publication, said: “While there is no conclusive evidence of insider trading, the wallet activity shows very strong directional conviction.”

“The timing and scale of the positions opened on October 10, immediately prior to the market-wide liquidation, does raise suspicion of information asymmetry.”

There had been no response from the White House to requests for comment.

Mr. Trump reignited his trade war against China while global markets were already nervous about having what could be like a dotcom-style bubble in technology stocks, inflated by exuberance over artificial intelligence. On the banks of two chaotic bankruptcies in the US, there are fears that the $3 trillion private credit market, also referred to as shadow banking, could be teetering on the brink of collapse due to lack of supervision.

The US action was in response to last week’s announcement by Beijing of strict export controls regulating any products, anywhere in the world, that contain rare earth minerals sourced from its mines. The rules apply to everything from cars to missiles to solar panels; this is an extraordinary grab by Beijing.

MR TRUMP SAID :

Mr. Trump said that it was evidence that China was becoming “very hostile” and was trying to “make life difficult for virtually every country in the world.”

The new tariff threat will push duties on goods imported from China up by 130 percent, since the US already imposes a 30 percent levy on imports. Mr. Trump plans to introduce the new tariffs on November 1, though he may act even sooner.

Nicolas Bickel, investment head at Edmond de Rothschild basically said that this tariff threat is apparently “clearly unexpected” to the market.

“The 100pc duties are going to be around 60pc higher than those on average before,” he said.

Chris Beauchamp, analyst at IG, noted that the stock market was set up for a “potentially volatile Monday open.”

Although the bubble burst, fears surrounding the turbulence still linger on increasing with already intensed speculation concerning possible bubbling in AI.

The Bank of England warned last week that overvalued technology stocks could pose a “material” danger to the British economy. Jamie Dimon, CEO of JP Morgan, made such a comment on BBC this week, stating that he was “far more worried than others” when it came to potential “sharp correction” in stock markets, with stretched valuations being the reason.

This would also expose an estimated $3tn private debt market to any stock market crash. This lightly regulated “shadow banking” market has been under intense scrutiny these past weeks after two US companies made heavy use of this source of funding that failed.

First Brands, an Ohio automotive component supplier, collapsed last month, saddled with $11.6 billion in liabilities. Tricolour, the third-largest used car retailer in Texas and California, filed for bankruptcy protection in September while owing more than $1 billion.

Private credit firms backed both ventures heavily, and lightly regulated money managers lent to companies instead of banks. This segment of the market grew rapidly over the past several years and now forms a $3-trillion industry.

The failures prompted investors to question how private equity firms value their loans and how thoroughly they perform due diligence in the sector.

. Deutsche Bank purportedly characterized First Brands as a “canary in the mine” for the industry.

Shares priced by Apollo, Blackstone, KKR, and Ares, the investment giants pioneering private credit, traded down by an average of 4.5 percent of Friday, making them down approximately 18 percent since the beginning of the month.

Also Read :What happened in Kabul Last night – changed everything